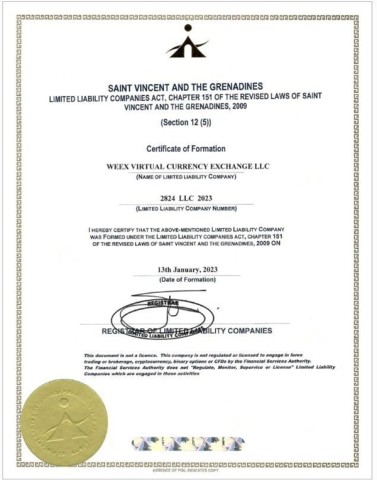

WEEX Officially Obtains SVGFSA License, Accelerating Global Expansion Strategy

Futures trading platform, WEEX, recently announced that it has obtained the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) license, with registration number 2824. This marks the platform’s third global regulatory license, following the acquisition of the US MSB and Canadian MSB licenses, and will contribute to accelerating WEEX’s ongoing global expansion strategy.

Saint Vincent and the Grenadines (SVG) is a member of the Commonwealth and serves as an important offshore financial center in the Caribbean. It is also recognized as a significant offshore regulatory jurisdiction, with its financial regulatory authority being the SVGFSA (Saint Vincent and the Grenadines Financial Services Authority). Over the past few years, SVG has made significant legislative efforts, positioning itself ahead of international trends. These legislative changes have solidified the nation’s established reputation for integrity and elevated its international financial services to world-class standards, earning it the nickname “a beautiful old offshore market.”

The SVGFSA license is a government-recognized and regulated license for legal cryptocurrency operations, allowing license holders to engage in various activities such as mining and exchange operations. WEEX is one of the few cryptocurrency exchanges regulated and recognized by the SVG government, joining the ranks of EuEasy OKX, CoinW Win, and others.

Recent risk events in 2022, involving Terra, Three Arrows Capital, FTX, and others, have not only caught the attention of regulatory agencies worldwide but also highlighted the urgent need for strengthened regulation and increased operational transparency in the cryptocurrency market. Regulatory bodies must adopt progressive regulatory measures while actively embracing blockchain technology innovations to effectively control risks and create a conducive environment for orderly and robust market development.

As we enter 2023, there is a significant rise in calls from various countries to enhance cryptocurrency market regulations. The International Monetary Fund (IMF) has urged increased regulatory actions to mitigate the impact of cryptocurrency volatility on banks and traditional financial institutions. The European Union proposes legislation that designates cryptocurrencies as one of the riskiest asset categories for banks. The United States is considering legislation regarding stablecoins, and the Commodity Futures Trading Commission (CFTC) plans to strengthen regulation on cryptocurrency trading.

Moreover, Kazakhstan has passed a bill to regulate cryptocurrency mining and trading, South Korea is accelerating the formulation of the Digital Assets Basic Act (DABA), Dubai has introduced the 2023 Virtual Assets and Related Activities Regulations, and Central Africa has established a special committee to draft legislation for the use of cryptocurrencies and tokenization. Countries such as the UK, France, Italy, India, Hong Kong, Indonesia, the Philippines, Argentina, and South Africa have also initiated relevant measures regarding cryptocurrency regulation.

Overall, the mainstream approach of countries towards the cryptocurrency market is to define legal boundaries, establish compliance operations, strengthen risk management, protect investors, and combat illegal activities such as money laundering and fraud. This aligns with the industry’s expectations and serves as a critical pillar for rebuilding confidence in the cryptocurrency market in 2023.

WEEX believes that the era of unregulated growth in the cryptocurrency industry is behind us, and the trend towards compliance is inevitable. As an exchange, compliance and security are crucial. Embracing regulation proactively, seeking compliance in a regulatory framework, and operating transparently are essential to gain user trust, achieve stability, and ensure sustainable development.

In this regard, WEEX is aligning with the regulatory trend, actively responding to the regulatory requirements for cryptocurrency asset trading in various countries, and cooperating with government demands for relevant licenses. In addition to the already acquired US MSB, Canadian MSB, and SVGFSA licenses, WEEX is also applying for regulatory licenses in Australia (DCE), the Philippines’ central bank, Malta, Malaysia, and other countries. The platform strives to provide the most professional, secure, and privacy-focused trading services for more global markets, built on compliance and transparency.

Media Contact

Company Name: WEEX Exchange

Email: Send Email

Country: Singapore

Website: https://www.weex.com